Pre-invoicing Transport: Accelerate Cash Flow by 40%

Cash flow remains the lifeblood of any transport company. Yet thousands of invoices lie dormant in accounting department drawers, awaiting validation, sending, or payment. Automated pre-invoicing radically transforms this reality by accelerating collection cycles while freeing up precious time for your teams.

Pre-invoicing vs Invoicing: Understanding the Difference and Impact on Your Cash Flow

What is a Pre-invoice?

A pre-invoice, sometimes written as pre invoice or preinvoice, constitutes a provisional document issued before the final invoice. In the transport sector, it allows you to announce the amount due to the client for services rendered, even before the administrative closure of the file. Unlike an invoice, it has no definitive accounting value but serves as a basis for validation. This distinction may seem trivial, but its impact on your cash flow is considerable.

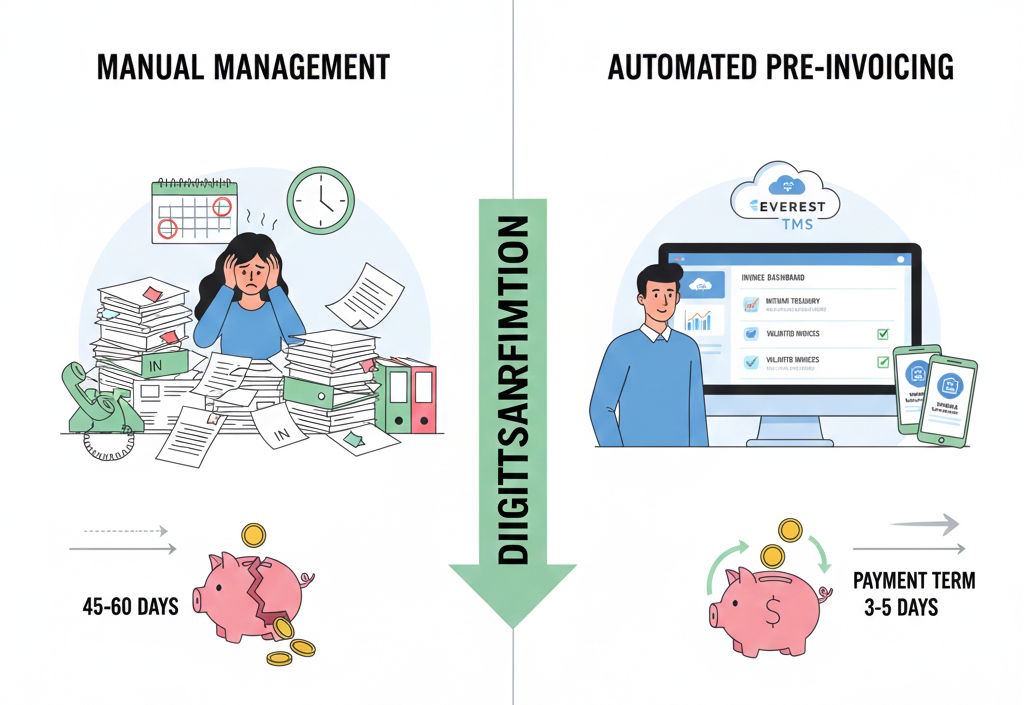

The Cash Flow Challenge Strangling Carriers

Payment terms in transport regularly exceed 45 to 60 days, sometimes more for subcontractors who must wait for validation and payment from the final client. These delays create a critical gap between your operational expenses and your collections. Fuel is paid for in cash, driver salaries fall due each month, maintenance cannot wait. But the money is slow to come in. Automated pre-invoicing radically changes the equation. By generating documents immediately after each delivery, it accelerates client validation through data transparency. Periodic invoicing becomes consistent and predictable, while automatic reminders eliminate oversights. For a carrier managing 200 monthly missions with an average basket of €80, moving from 60 to 35 days payment terms frees up €16,000 in immediate cash flow. Enough to finally breathe.

Why 80% of Carriers Waste Time on This Process

The Vicious Circle of Manual Management

The majority of transport companies still manage their pre-invoicing manually, with direct consequences on their profitability. Every morning, the same routine begins again: you need to review yesterday’s delivery notes, verify the information, calculate rates according to pricing grids that differ by client, then enter everything into the accounting system. Manual entry of services requires each delivery to be transcribed, verified, and priced. Data arrives from everywhere: crumpled paper delivery notes at the bottom of a truck, scattered emails, phone calls that no one took complete notes on. Consolidating this information becomes a daily puzzle. Then come calculations of variable rates, between fuel surcharges, mileage supplements, and exceptional rates negotiated with this or that client. Phone reminders follow one another to obtain validations, then to claim payments. And when a dispute arises, it’s impossible to quickly find the associated proof of delivery. An administrative team devotes an average of 5 to 8 hours per week solely to pre-invoicing and collection tracking for 150 to 200 monthly missions. That’s a full day of work disappearing into low-value tasks.

The Costly Errors That Accumulate

Beyond lost time, errors accumulate silently and erode profitability. A forgotten supplement here, an unbilled option there, and hundreds of euros evaporate each week. Pricing errors create disputes with clients who contest the amounts. Invoicing delays mechanically extend payment terms since you can’t be paid for an invoice you haven’t yet issued. Difficulties in justification during client disputes transform each conflict into an exhausting administrative battle. These errors represent an average loss of 2 to 5% of annual turnover for carriers who haven’t automated their process. For a company with €800,000 in turnover, this means between €16,000 and €40,000 going up in smoke each year. Enough to hire an additional person or invest in new vehicles.

The Subcontracting Impasse

The situation becomes even more critical for subcontractor management. Carriers must juggle several issues simultaneously: receiving contractor invoices that arrive in different formats, verifying consistency with services actually rendered, creating their own client pre-invoices incorporating these costs, while managing the cash flow gap between when they pay their subcontractor and when they collect from their final client. Without an automated system, this process of contractor pre-invoicing becomes a time-consuming administrative headache. Some carriers admit spending more time on this than managing their own drivers. The irony is that subcontracting was supposed to simplify operations.

How to Automate Your Pre-invoicing End-to-End

It All Starts with Intelligent Pricing Grids

Automation begins with structuring your rates in your TMS. A high-performance system must allow you to configure your entire pricing policy with precision. Base pricing integrates your prices per kilometer, weight, or volume, as well as your zone-based packages and differentiated rates by client type. But the real power lies in managing options and supplements: automatic fuel surcharges indexed to CNR, time supplements for Saturday or evening deliveries, service options like confirmed appointments or upstairs delivery. Not to mention exceptional pricing rules for temporary promotions or negotiated conditions with your strategic clients. The system’s intelligence lies in its ability to automatically apply the right pricing grid to each mission, without manual intervention. Gone are the days when your administrative colleague had to wonder if Mr. Dupont benefited from the negotiated rate of €2.80 or €2.95 per kilometer.

The Automatic Generation That Changes Everything

Once missions are completed and proof of delivery collected by your drivers via the mobile application, the system automatically generates pre-invoices according to the frequency you’ve defined. Some clients operate on a per-job basis and need daily invoicing. Others prefer weekly consolidation for recurring distribution contracts. Large accounts typically expect their monthly invoicing with a complete summary. Each pre-invoice consolidates the detail of services rendered, rates applied with total transparency, associated proof of delivery including photos and electronic signatures, and a summary by service type that allows your client to immediately understand their invoice. No more unpleasant surprises, no more disputes about the origin of an amount.

Validation That No Longer Drags On

Automated email sending allows instant distribution upon generation. But the real revolution comes from the online portal accessible to your clients. They can view their pending pre-invoices at any time, download associated proof of delivery to verify everything is compliant, validate or contest each line if necessary, and track the complete history of their services over several months. This transparency considerably reduces validation times and disputes. Your clients are no longer in the dark; they have all the elements to validate quickly. And when a dispute arises despite everything, the evidence is there, accessible with one click.

From Pre-invoice to Collection Without Friction

Once validated, pre-invoices transform into final invoices with one click. The system generates legal documents with your logo and personalized mentions, automatically sends them in PDF format by email, then tracks payments with automatic matching of settlements arriving in your account. Automatic reminders trigger according to the schedule you’ve predefined: a first reminder at D+30, a second at D+45, a last at D+60 before you pick up the phone for a firmer call. This well-oiled mechanism radically transforms your cash flow management. Payments arrive faster, delays are identified immediately, and your team can focus on real anomalies rather than chasing invoices forgotten in a pile of mail.

Subcontractor Pre-invoicing Finally Mastered

Automation also extends to your contractors, and this is perhaps where the gain is most spectacular. The system receives their services directly in the platform, generates their pre-invoice automatically according to their own pricing grids that you’ve configured once and for all, tracks amounts owed and paid with precision, and even analyzes gaps between your subcontractor cost and your client billing to give you visibility on your real margins. This contractor pre-invoicing management becomes fluid and frictionless. You know exactly what you owe each one, you can anticipate your cash outflows, and above all you save considerable time on a previously chaotic process.

The Accounting Integration That Closes the Loop

When TMS Talks to Your Accountant

A modern TMS integrates natively with major accounting software. Automatic export of accounting entries eliminates any manual re-entry. Automatic matching of received payments happens without human intervention. Cash flow tracking becomes available in real time, and even bank reconciliation is facilitated by data consistency between your tools. This integration eliminates double entry that generates errors and frustrations, and guarantees perfect consistency between your operational management and your accounting. Your accountant will thank you, having spent hours trying to understand the origin of this or that gap between your transport documents and your accounting entries.

The Dashboard That Finally Gives Visibility

A dedicated dashboard offers complete visibility on your cash flow. At a glance, you see your pre-invoices awaiting validation, your issued but unpaid invoices classified by age, your collection forecasts based on each client’s payment history, your dispute rate by client to identify the most problematic ones, and your average payment terms by client segment to adjust your commercial strategy. These indicators allow you to quickly identify at-risk clients. The one who systematically pays at 75 days instead of the negotiated 45 deserves a commercial conversation. The one whose dispute rate reaches 15% may pose a service quality problem that needs resolving before they leave for a competitor.

The KPIs That Measure Your Performance

Essential metrics to track give a precise view of your operational efficiency. Average time between delivery and invoicing should ideally be less than 3 days. Pre-invoice validation rate is an excellent indicator of your service quality and should exceed 95%. Average payment time reflects both your clients’ financial health and your ability to follow up effectively. The dispute rate must remain below 5% to avoid your customer service spending its time putting out fires rather than developing customer relationships. These metrics allow you to measure the concrete impact of automation and identify areas for improvement. If your average payment time remains high despite automation, perhaps you’re too lenient on reminders. If your dispute rate increases, it may be a sign of a quality problem in the field.

The Figures That Speak for Themselves

Time Finally Recovered

Pre-invoicing automation generates spectacular time savings that your teams feel from the first weeks. Manual entry of services, once time-consuming, disappears by 80%. Phone exchanges for reminders decrease by 70% because clients automatically receive their reminders. Pricing calculation errors almost completely evaporate, and manual consolidation tasks that took hours are eliminated. For a team devoting 6 hours weekly to these tasks, automation frees up nearly 5 hours per week. Over a year, this represents 260 hours that can be reinvested in business development, customer service improvement, or simply a better quality of life for your employees who no longer finish their days at 8 PM to close out invoicing.

Cash Flow That Finally Breathes

The figures speak for themselves and radically transform carriers’ financial health. Average reduction in payment terms reaches 40%, which completely changes the equation for cash flow under pressure. The amount of old receivables over 60 days decreases by 60%, a sign that automatic reminders are doing their job effectively. Payment rate at due date increases by 25% because clients receive their invoices on time and have all the elements to validate quickly. For a carrier with €50,000 in monthly receivables, moving from 55 to 35 days average delay frees up €33,000 in permanent cash flow. That’s the equivalent of several new vehicles, or the ability to seize a commercial opportunity without having to negotiate a bank overdraft.

Customer Relationships That Professionalize

Beyond direct financial gains, automation significantly improves customer relationships in a way that’s felt over time. Total transparency on services and rates applied avoids misunderstandings. Increased responsiveness with 24/7 access to documents places your clients in a position of control, which they particularly appreciate. Enhanced professionalism with white-label documents helps you gain credibility against major transport groups. Drastic reduction in disputes thanks to instantly accessible proof transforms tense phone conversations into factual and quick exchanges.

How Everest Revolutionizes Transport Pre-invoicing

Pricing Grids as Complex as Necessary

Everest allows you to create sophisticated pricing grids adapted to each client, without any complexity limits. Multi-criteria configuration simultaneously integrates distance, weight, volume, geographic zone, and delivery times. Fuel surcharge management automatically indexes to CNR indices, freeing you from the monthly update chore. Options and supplements are fully configurable by client, and exceptional rates for particular situations are configured in a few clicks. The system’s flexibility allows managing even the most complex pricing grids without compromise. One of our clients manages 47 different pricing grids with over 200 total parameters. The system automatically calculates the right rate in a fraction of a second.

End-to-End Automation

From service to collection, each step automates without human intervention. Automatic generation triggers upon validation of proof of delivery by drivers. Scheduled sending respects the frequency defined for each client. The client portal allows online consultation and validation 24/7. Conversion to final invoice happens with one click. Automatic reminders trigger according to your parameters without you having to think about it. This perfectly oiled mechanism transforms your daily routine. Your teams discover the luxury of starting their day without that pit in their stomach related to overdue invoices.

Subcontractor Pre-invoicing Finally Simple

Everest radically simplifies your contractor management with a dedicated module that changes the game. Reception of their services happens directly in the platform, without re-entry. Automatic calculation applies their pricing grids that you’ve configured. Generation of their periodic pre-invoicing occurs on agreed dates. Tracking of matching and payments made gives you a clear view of what you owe them. Margin analysis by contractor reveals your most profitable carriers and those eroding your profitability.

Native Accounting Integration That Avoids Any Re-entry

Invoicing data synchronizes automatically with your accounting tools, whether Sage, Cegid, Quadratus, or other solutions. This integration eliminates all double entry and guarantees perfect consistency of your financial data between your operational management and your accounting.

The Dashboard That Gives the Big Picture

Instantly visualize the amount of your pre-invoices awaiting validation, your issued but unpaid invoices with their age, your collection forecasts based on history, your analysis of delays by client, and all your performance indicators on a single screen. No more need to cross-reference three Excel files to know where you stand.

The Essential Takeaway

Automated pre-invoicing represents a major strategic lever for improving transport company profitability. By eliminating time-consuming manual tasks and accelerating collection cycles, it frees up to 40% additional cash flow while drastically reducing errors and disputes. The three pillars of success rest on complete automation of the pre-invoicing cycle from delivery to collection, native integration with your accounting tools to avoid any re-entry, and real-time visibility on your collections to effectively manage your cash flow. In a sector where margins are decided by a few percentage points, optimizing your invoicing process is no longer an option but a strategic necessity. Carriers who digitize this process today take a decisive lead over their competitors, with measurable impact from the first month of use. While others continue to lose hours in manual entry and thousands of euros in payment delays, you can focus on what really matters: developing your business and satisfying your customers.

Ready to transform your invoicing process? Discover how Everest can help you automate your pre-invoicing and accelerate your collections. Our teams support you in configuring your pricing grids and implementing workflows adapted to your business. Request a demo