Microhubs & Consolidation: Last Mile Revolution 2025

The urban transport landscape is undergoing a profound transformation. Between the continued explosion of e-commerce, expanding low-emission zones, and mounting pressure to decarbonize, last-mile delivery operators must reinvent their operating models. At the heart of this transformation, two concepts are emerging as essential solutions: microhubs and logistics flow consolidation.

The Infrastructure Changing Everything: Focus on Urban Microhubs

Paris Leads the Way with the Gobelins Logistics Hotel

The 2025 opening of SEGRO Centre Paris Les Gobelins marks a turning point for French urban logistics. Located in the former freight station of the 13th arrondissement, this 75,000 m² logistics hotel perfectly illustrates the new generation of infrastructure designed for last-mile delivery. Divided into modular units ranging from 700 to 14,000 m², this urban hub accommodates both 44-ton trucks and cargo bikes, embodying the complementary transport modes that characterize modern logistics. DB Schenker, the site’s first tenant, plans 250 daily B2B deliveries starting June 2025, primarily using cargo bikes and electric vehicles. This infrastructure is more than just a warehouse: it’s a true ecosystem integrating proximity services for residents, a 500 m² innovation space to test logistics solutions, and an optimized distribution center for decarbonized delivery.

Microhubs: Small Footprint, Major Impact

Beyond large logistics hotels, microhubs are revolutionizing the approach to urban storage. These mini-platforms, often installed in parking spaces or underutilized areas, address a simple but crucial challenge: bringing goods closer to end recipients to enable soft-mode delivery. Concretely, a microhub means:

- A 50 to 500 m² surface area in the city center

- A transfer point between heavy trucks and cargo bikes

- Temporary storage to avoid waiting times

- Up to 85% reduction in CO2 emissions within its catchment area

In Nantes, the Sofub project is currently testing several microhubs in partnership with Amazon Logistics and La Poste. In Paris, Sogaris is experimenting with modules installed directly on roadways. Lyon is multiplying initiatives with the ColisActiv’ program, which already generates 50,000 monthly cycle-logistics deliveries.

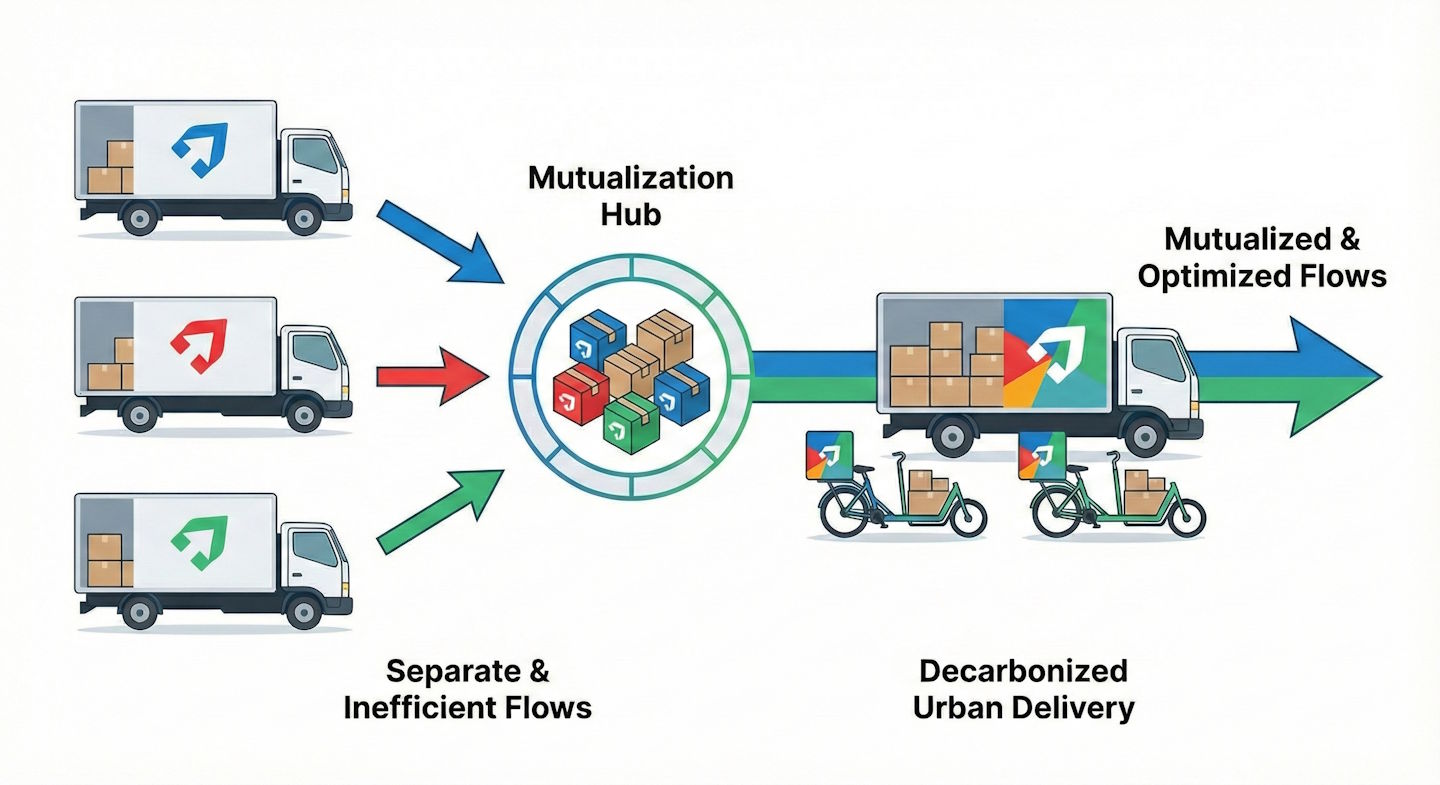

Consolidation: When Sharing Becomes Profitable

A Business Model That Proves Itself

Logistics flow consolidation is no longer just an ecological option; it has become an economic imperative. By grouping orders from different customers in the same vehicle, carriers optimize their fill rates and drastically reduce their operating costs. Measurable benefits of consolidation:

- 20 to 30% reduction in logistics costs through massification

- Increase in vehicle fill rate up to +22%

- 25% decrease in CO2 emissions in urban areas

- Significant reduction in the number of vehicles circulating downtown

For transport operators, this approach transforms the economic equation. Rather than running half-empty vans to serve a few scattered customers, consolidation allows for concentrated flows, optimized routes, and profitable every kilometer traveled.

Infrastructure Facilitates Collaboration

Logistics hotels and microhubs become natural meeting points for consolidation. By temporarily centralizing goods from multiple carriers, these spaces allow for reconstituted loads optimized according to final destinations. This collaborative logic was difficult to implement when each carrier operated from their own peripheral base. Shared urban infrastructure creates the physical conditions for genuine cooperation between competitors.

200 Cycle-Logistics Companies Structure an Industry

The rise of urban infrastructure accompanies the professionalization of cycle-logistics. Today, 200 specialized companies operate in 74 French cities, driven by the development of these new facilities.

The Winning Equation: Microhubs + Cargo Bikes

Microhubs solve the main limitation of bicycle deliveries: reduced range. By positioning storage points just a few kilometers from dense delivery zones, the operating radius of cargo bikes multiplies while avoiding long approach trips from the periphery. A cargo trike can thus make several daily rotations from a central microhub, where a single round trip from a peripheral warehouse would have taken the entire day. Productivity soars, making cycle-logistics economically viable at significant volumes.

Evolving Capacities

New cycle-logistics vehicles now approach the capacities of light utility vehicles. Heavy cargo trikes and trailers can transport up to 300 kg of goods, even complete pallets. This technical evolution, combined with adapted infrastructure, repositions bicycle delivery as a credible alternative rather than a marginal option.

LEZ: The Regulatory Framework Accelerating the Movement

2025 Marks a Tightening of Restrictions

Low Emission Zones (LEZ) are expanding and strengthening throughout France. In 45 metropolitan areas, only Crit’Air 1 and electric vehicles can now circulate downtown. This regulatory constraint becomes the main accelerator of investments in decarbonized infrastructure. For traditional carriers equipped with diesel fleets, the equation is simple: either invest massively in expensive electric vehicles or completely rethink their logistics organization by relying on microhubs and alternative transport modes.

Public Support Structures the Offering

The French government has included sustainable urban logistics in its 2025-2026 roadmap with 23 concrete measures. The objective: 30,000 light electric vehicles in service by 2026. But beyond vehicles, the entire infrastructure benefits from funding and project calls. ADEME, through its eXtrême Défi Logistique program, actively supports the deployment of microhubs and urban distribution centers. These public initiatives create a favorable environment for private actors to invest massively in these new infrastructures.

Operational Challenges to Overcome

The Urban Real Estate Problem

Paris accounts for only 1% of warehouse surfaces in the Île-de-France region while concentrating more than 60% of goods flows. This real estate scarcity explains why microhubs install in atypical locations: underutilized parking lots, former stations, spaces under platforms… Implementation costs remain high, but the equation improves when integrating savings generated by consolidation and last-mile optimization. Viable projects often rely on initial public support and value-added services like storage or order preparation.

Coordination Between Multiple Actors

Consolidation assumes that competitors agree to share infrastructure and sometimes even data. This cultural change remains one of the main obstacles to massive deployment. Urban logistics hotels attempt to solve this equation by offering private spaces while facilitating inbound and outbound flow consolidation. Digital platforms play an increasing role in orchestrating this complexity. Modern TMS now integrate intelligent consolidation functionalities, automatically combining orders from different customers into optimized routes.

How TMS Adapt to This New Reality

Multi-Site and Multi-Mode Optimization

The multiplication of urban storage points transforms logistics management needs. A performing TMS must now simultaneously manage:

- Multiple hubs with differentiated stock levels

- A combination of transport modes (heavy trucks, electric LCVs, cargo bikes)

- Automatic assignment rules according to LEZ and time constraints

- Intelligent flow consolidation between different customers

Real-Time Tracking and Enhanced Traceability

With flows transiting through several points before reaching the final recipient, traceability becomes critical. Customers want to know precisely where their order is, whether in a microhub, in transit to another site, or in final delivery. Real-time geolocation functionalities, dynamic ETA calculations, and automatic alerts are no longer options but prerequisites. This total visibility reassures end customers while allowing dispatch teams to anticipate and react to unforeseen events.

Interconnection with the Ecosystem

Shared urban infrastructure requires different actors to exchange information fluidly. A modern TMS must therefore offer:

- Robust APIs to connect to urban hub systems

- Automation modules to synchronize data without re-entry

- The ability to integrate specific constraints of each microhub (access hours, storage capacities, available transport modes)

Three Scenarios to Integrate These Developments

Scenario 1: The Carrier Who Equips Themselves

For a growing carrier, investing in space within an urban logistics hotel becomes strategic. This location allows to:

- Reduce average delivery distances by 40 to 60%

- Access city centers despite LEZ thanks to cargo bikes

- Offer tighter delivery time slots

- Consolidate certain flows with other hub occupants

The TMS becomes the central tool to orchestrate flows between the main peripheral warehouse and the urban hub, then manage the dispatch of final deliveries according to available transport modes.

Scenario 2: The Retailer Taking Control

Omnichannel brands develop their own ship-from-store and ultra-fast delivery strategies. Microhubs allow them to store near dense areas without immobilizing expensive commercial space. A white-label TMS offers the advantage of managing these flows while providing a fully branded customer experience. Notifications, tracking links, and public interfaces display the brand’s identity, strengthening the direct customer relationship.

Scenario 3: The Cycle-Logistics Operator Scaling Up

For cycle-logistics companies, microhubs are the missing link to move from artisanal stage to industrialization. The hub + performing TMS combination allows to:

- Manage volumes 5 to 10 times higher with the same fleet

- Automate dispatch between couriers according to their competence zones

- Optimize routes in real time according to incoming orders

- Precisely value the avoided CO2 impact for customers

Key Indicators to Monitor for Effective Management

Operating from shared infrastructure requires new KPIs: Operational Performance:

- Stock rotation rate in microhub (ideally < 24h)

- Average vehicle fill rate (target > 80%)

- Average number of stops per route from the hub

- Hub crossing time (duration between arrival and final departure)

Environmental Impact:

- CO2 emissions per delivered parcel

- Share of soft-mode deliveries (increasing target)

- Kilometers avoided through consolidation

Model Economics:

- Complete cost per delivered parcel (including hub)

- Savings generated by consolidation

- ROI of urban infrastructure location

These indicators must be monitored via the TMS dashboard to continuously adjust the organization and identify optimization levers.

Key Takeaways

Microhubs and consolidation are no longer experimental concepts but operational realities that profoundly transform last-mile delivery in 2025. The opening of infrastructure like SEGRO Centre Paris Les Gobelins, the structuring of the cycle-logistics sector in 74 cities, and the tightening of LEZ create conditions for a massive shift toward these new models. For carriers, retailers, and cycle-logistics operators, the message is clear: shared urban infrastructure becomes the essential foundation for operating efficiently in cities. This evolution accompanies new technological needs, particularly TMS capable of managing multi-site, multi-mode, and multi-actor complexity. Successful operators will be those who can combine three dimensions: access to the right physical infrastructure, digital tools to orchestrate effectively, and the ability to collaborate in a shared ecosystem. The era of the isolated carrier operating from a single peripheral warehouse is coming to an end. Welcome to hybrid, collaborative, and urban models. In this new logistics configuration, having a TMS adapted to these challenges is no longer a luxury but a strategic necessity to remain competitive.